SEC Freezes Crypto: The Illusion Continues. - #CryptoInsights

Global Crypto Policy: "Clarity" or Just Treading Water?

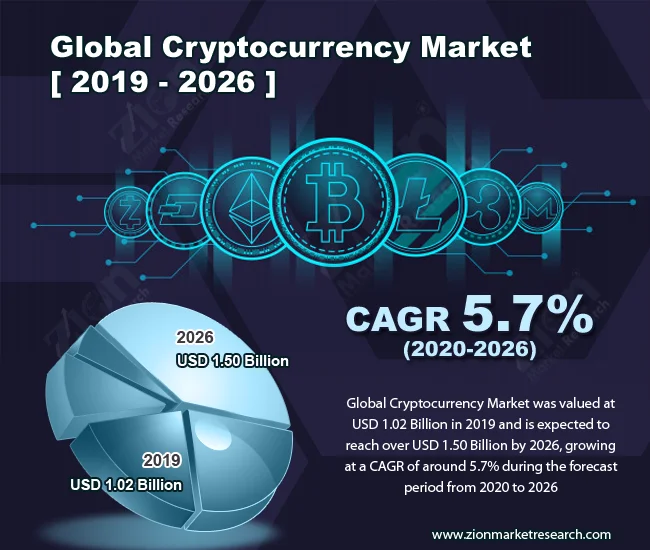

So, 2025, huh? The year crypto "regulation" finally got its act together? Please. I've heard that song and dance before. Every year is supposedly the year crypto goes legit, and every year it's the same old story: hype, crashes, and politicians grandstanding. This Global Crypto Policy Review Outlook 2025/26 Report is just another brick in the wall of crypto PR.

Stablecoins: The Shiny Distraction

Seventy percent of jurisdictions "progressing" stablecoin regulation? Okay, great. What does that even mean? Progressing could mean anything from actually passing laws to just having a committee meet and talk about it over coffee. Let's be real, stablecoins are just a way to make the whole crypto casino seem less volatile to the normies.

The GENIUS Act: Government Endorsed Nonsense?

And this GENIUS Act in the US? Don't even get me started. More like the "Government Endorsed Nonsense Intended to Undermine Sanity" Act. Another set of regulations to be exploited.

Institutional Adoption: A Controlled Entry Point

The report says stablecoins are the "entry point for institutional adoption." Translation: Big banks want a piece of the pie, but they need enough red tape to make sure they're the only ones who get to eat. It's not about innovation; it's about control.

Institutions: Cautious Dance or Full Embrace?

Eighty percent of jurisdictions saw financial institutions announce "digital asset initiatives?" Another meaningless statistic. Announcing an initiative is not the same as actually doing something. It's a press release, a photo op, and a pat on the back.

Basel Committee: Reassessing or Raising the Rent?

And the Basel Committee "reassessing" its prudential rules? They expect us to believe this nonsense, and honestly... This whole thing reminds me of when my landlord "reassessed" my rent, which meant it mysteriously went up.

The Risk of Bailouts: Who Pays the Price?

What happens when these institutions start losing money on crypto? Will they come crying to the government for a bailout? Offcourse, they will. And who pays for that? You and me.

Institutional Readiness: Jumping on the Bandwagon?

Here's a question nobody seems to be asking: Are these institutions actually equipped to handle the risks of crypto? Or are they just jumping on the bandwagon because they don't want to be left behind?

Illicit Finance: A Game of Whack-a-Mole

The report pats itself on the back about how regulation is reducing illicit finance in crypto. Right, and I bet the war on drugs is totally winning, too. Sure, regulated VASPs might have lower rates of illicit activity, but what about all the unregulated corners of the ecosystem? The DeFi protocols, the privacy coins, the OTC desks in shady jurisdictions...it's all still there, just harder to track.

North Korea Hack: The Usual Suspects

And this North Korea hack on Bybit? USD 1.5 billion gone, poof. Laundered through all the usual suspects: unlicensed OTC brokers, cross-chain bridges, decentralized exchanges. The report calls for "better cross-jurisdictional coordination and real-time information sharing." Good luck with that. Getting governments to agree on anything is like herding cats.

International Standards: Blame Game

International bodies are warning about gaps in standards implementation. Of course. It's always someone else's fault.

Give Me a Break...

So, what's the punchline? All this "progress" is just a smokescreen. The crypto market is still a wild west, and regulation is always playing catch-up. The big players are positioning themselves to profit, and the little guy is still going to get rekt. Maybe I'm just too cynical, but I've seen this movie before. The names change, the faces change, but the plot stays the same.

Why FIU's AI is Small Business's Next Big Leap - AI Empowered!

Next PostThis is the latest post.

Related Articles